Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Filed by the Registrant ☐ Filed by a Party other than the Registrant |

|

Check the appropriate box: |

☐Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant tounder §240.14a-12 |

Histogenics Corporation

OCUGEN, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required. |

| |

| |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| |

☐ | Fee paid previously with preliminary materials. |

| |

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

Table of Contents

Histogenics Corporation

830 Winter Street, 3rd Floor

Waltham, MA 024515 Great Valley Parkway, Suite 160

NOTICE OFMalvern, PA 19355

2019 ANNUAL MEETING OF STOCKHOLDERS

To be Held on December 18, 2019

To Be Held On June 15, 2018

November 8, 2019

Dear Stockholder:

You

We are cordially invitedpleased to invite you to attend theOcugen, Inc.’s 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Histogenics Corporation, a Delaware corporation (the “Company”). The Annual Meeting, which will be held on June 15, 2018, at 9:8:00 a.m. local time, Eastern Time, on Wednesday, December 18, 2019, at the offices of Gunderson Dettmer Stough Villeneuve Franklin & Hachigian,Pepper Hamilton LLP, located at One Marina400 Berwyn Park, Drive, Suite 900, Boston, MA 02210 forBerwyn, PA 19312.

Details regarding admission to the following purposes:

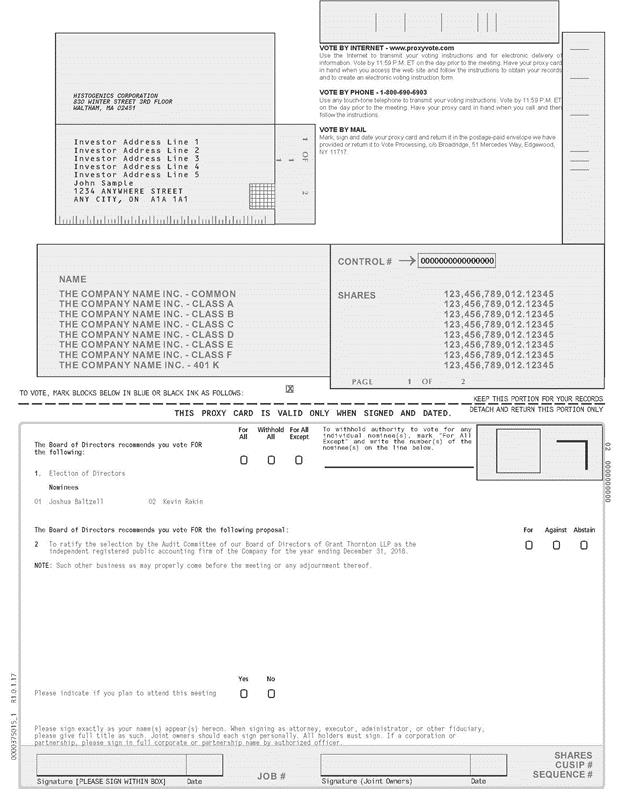

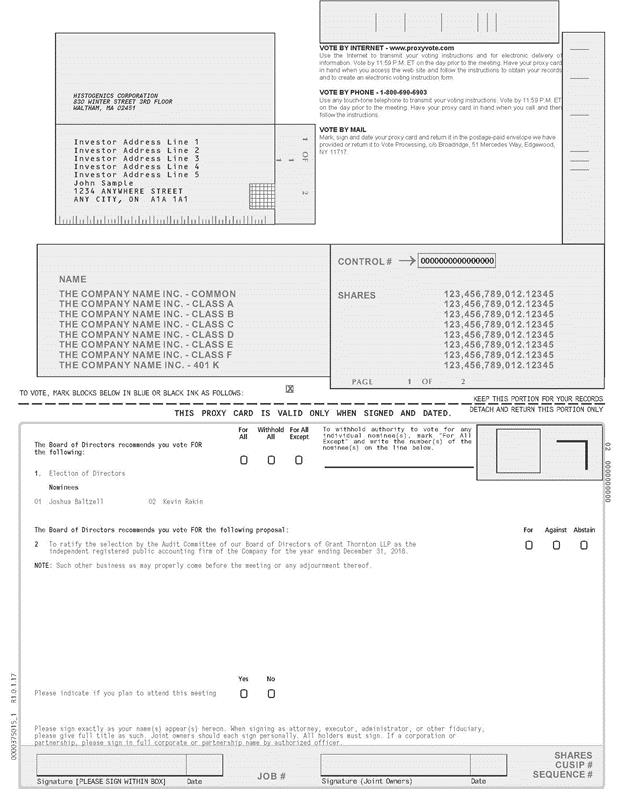

| 1.

| To elect Joshua Baltzellmeeting and Kevin Rakin to serve as Class I directors until the 2021 annual meeting of stockholders;

|

| 2.

| To ratify the selection by the Audit Committee of the Board of Directors of Grant Thornton LLP as our independent registered public accounting firm of the Company for the year ending December 31, 2018; and

|

| 3.

| To conduct any other business properly brought before the Annual Meeting or any adjournments or postponements thereof.

|

The record date for the business to be conducted are more fully described in the accompanying Notice of 2019 Annual Meeting of Stockholders (the “Notice”) and 2019 Annual Meeting Proxy Statement (the “Proxy Statement”). Other than the proposals described in the Proxy Statement, the Board of Directors (the “Board”), is April 23, 2018. Only stockholdersnot aware of record at the close of business on that date are entitledany other matters to notice of and tobe presented for a vote at the Annual Meeting or any adjournment thereof. A complete listMeeting. We are pleased to take advantage of such stockholders will be available for inspection at our offices in Waltham, Massachusetts during normal business hours for a period of ten days priorSecurities and Exchange Commission rules that allow companies to furnish their proxy materials over the Annual Meeting.Internet.

YOUR VOTE IS IMPORTANT!

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. Information about voting methods is set forth in person,the accompanying Notice and Proxy Statement.

Table of Contents

If you have any questions with respect to voting, please call our Vice President, Investor Relations and Administration, Kelly Beck, at (484) 328-4698.

Sincerely,

/s/Shankar Musunuri | |

Shankar Musunuri, Ph.D., MBA | |

| |

Chairman of the Board and Chief Executive Officer | |

THIS PROXY STATEMENT AND ENCLOSED PROXY CARD ARE

FIRST BEING MADE AVAILABLE ON OR ABOUT NOVEMBER 8, 2019.

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

You are invited to attend Ocugen, Inc.’s 2019 Annual Meeting of Stockholders. At the Annual Meeting, stockholders will vote:

· to elect the two director nominees that are set forth in the attached Proxy Statement to serve as Class II directors, whose term will expire in 2022;

· to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the 2019 fiscal year; and

· to approve the adoption of our 2019 Equity Incentive Plan.

Stockholders will also transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

MEETING INFORMATION:

Date: | | Wednesday, December 18, 2019 |

| | |

Time: | | 8:00 a.m., Eastern Time |

| | |

Location: | | The offices of Pepper Hamilton LLP, 400 Berwyn Park, Berwyn, PA 19312 |

| | |

Record Date: | | Friday, October 25, 2019 |

Your vote matters. Whether or not you plan to attend the Annual Meeting, please ensure that your shares are represented by telephone or over the internet, or by completing,voting, signing, dating and returning your proxy card or voting instruction form so that your shares will be represented at the Annual Meeting. Instructions for voting are described in the Company’s proxy statement forenclosed envelope, which requires no postage if mailed in the Annual Meeting, Notice of Internet Availability of Proxy Materials or proxy card.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on JUNE 15, 2018United States.:

The Company’s Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2017 are available at www.proxyvote.com.

|

|

By Order of the Board of Directors |

|

|

Adam Gridley

| |

| /s/ Kelly Beck |

| |

| Kelly Beck |

| |

| Corporate Secretary |

| |

| November 8, 2019 |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS. This proxy statement and the proxy card are being furnished to our stockholders on or about November 8, 2019. This proxy statement and our 2018 Annual Report on Form 10-K describing the former business of Histogenics Corporation are available to holders of our common stock at www.Proxyvote.com. If you would like to receive, without charge, a paper copy of our 2018 Annual Report, including the financial statements, please send your request to Vice

Table of Contents

President, Investor Relations and Administration, Ocugen, Inc. 5 Great Valley Parkway, Suite 160, Malvern, PA 19355.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement |

Table of Contents

President and Chief Executive OfficerSUMMARY INFORMATION

|

To assist you in reviewing this year’s proposals, we call your attention to the following proxy summary. This is only a summary; please review this Proxy Statement and our 2018 Annual Report in full.

General Meeting Information

Date: | December 18, 2019 |

|

|

Time: | 8:00 a.m. Eastern time |

|

|

Location: | The offices of Pepper Hamilton LLP, 400 Berwyn Park, Berwyn, PA 19312. |

|

|

Record Date: | October 25, 2019 |

Voting Matters and Voting Recommendations

Proposal

| For More

Information

| Board of Directors

Recommendation

|

Item 1: Election of Class II Directors for a Three-Year Term Expiring in 2022 Waltham, MassachusettsUday B. Kompella, Ph.D. and Manish Potti

April 26, 2018

| Page 41 | ✓ FOR Each Nominee |

Item 2: Ratification of Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2019 | Page 41 | ✓ FOR |

Item 3: Approval of the Adoption of our 2019 Equity Incentive Plan (the “2019 Plan”) | Page 42 | ✓ FOR |

Our Director Nominees

You are being asked to vote on the election of Uday B. Kompella, Ph.D. and Manish Potti as Class II directors, each to serve for a three-year term expiring at our 2022 Annual Meeting of Stockholders. The number of members of our Board is currently set at seven members and is divided into three classes, each of which has a three-year term. Classes II and III each consist of two directors, while Class I consists of three directors.

The term of office of our Class II directors expires at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”). We are nominating Uday B. Kompella, Ph.D. and Manish Potti for election at the Annual Meeting to serve until the 2022 Annual Meeting of Stockholders and until their successors, if any, are elected or appointed, or their earlier death, resignation, retirement, disqualification or removal. Directors are elected by a plurality of the votes cast by our stockholders at the Annual Meeting. The two nominees receiving the most FOR votes (among votes properly cast in person or by proxy) will be elected. If no contrary indication is made, shares represented by executed proxies will be voted FOR the election of Uday B. Kompella, Ph.D. and Manish Potti. Each nominee has agreed to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement | i

Table of Contents

SUMMARY INFORMATION (CONTINUED) |

| | | | Committee Memberships |

Name | Age | Director

Since | Occupation | Independent | AC | CC | NCGC | Other Current Public Company Boards |

Uday B. Kompella, Ph.D. | 52 | 2019 | Founder and Director of Ocugen, Inc. | Yes | | | M | None |

Manish Potti | 33 | 2019 | Director of Ocugen, Inc. | Yes | M | M | | None |

AC = Audit Committee | | CC = Compensation Committee | | C = Chair |

| | | | |

NCGC = Nominating and Corporate Governance Committee | | M = Member |

CORPORATE GOVERNANCE SUMMARY FACTS

The following table summarizes our current Board structure and key elements of our corporate governance framework:

Governance Item

| |

Size of Board (set by the Board) | 7 |

Number of Independent Directors | 6 |

Independent Chairman of the Board | No |

Board Self-Evaluation | Annual |

Review of Independence of Board | Annual |

Independent Directors Meet Without Management Present | Yes |

Voting Standard for Election of Directors in Uncontested Elections | Plurality |

Diversity of Board Background, Experience and Skills | Yes |

TABLE OF CONTENTSNotice of Annual Meeting of Stockholders and 2019 Proxy Statement |

Table of Contents

PROXY STATEMENT

This Proxy Statement, with the enclosed proxy card, is being furnished to stockholders of Ocugen, Inc. in connection with the solicitation by our Board of proxies to be voted at our Annual Meeting and at any postponements or adjournments thereof. The Annual Meeting will be held on Wednesday, December 18, 2019, at 8:00 a.m., Eastern Time, at the offices of Pepper Hamilton LLP, 400 Berwyn Park, Berwyn, PA 19312.

THIS PROXY STATEMENT AND THE ENCLOSED PROXY CARD ARE FIRST BEING FURNISHED TO OUR STOCKHOLDERS ON OR ABOUT NOVEMBER 8, 2019. THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS BEING MAILED TO THE STOCKHOLDERS IS NOT PART OF THE PROXY STATEMENT.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement |iii

Table of Contents

Merger of Histogenics Corporation and Ocugen, Inc.

On September 27, 2019, Histogenics Corporation (“Histogenics”) completed a reverse merger of a wholly-owned subsidiary of Histogenics (“Merger Sub”) with privately held Ocugen, Inc. (“Former Ocugen”) with Former Ocugen surviving the Merger as our wholly-owned subsidiary in accordance with the terms of an Agreement and Plan of Merger and Reorganization dated April 5, 2019, as amended (the “Merger Agreement”), by and among Histogenics, Merger Sub and Former Ocugen. Prior to the reverse merger Former Ocugen operated as a separate, private entity. Upon completion of the merger, Former Ocugen changed its name to Ocugen OpCo (“OpCo”) and we changed our name to Ocugen, Inc. (“Ocugen”). On September 30, 2019 our common stock began trading on Nasdaq Capital Market (“Nasdaq”) under the new ticker symbol “OCGN.”

Immediately prior to the Merger, Histogenics completed a 1-for-60 reverse stock split (the “Stock Split”). All share and per share amounts in this proxy statement reflect the Stock Split unless otherwise noted. As a result of the Merger and, after giving effect to the Stock Split, each outstanding share of OpCo share capital (including shares of OpCo share capital to be issued upon exercise of outstanding share options) was exchanged for 0.4794 shares of the Histogenics’s common stock. We also assumed all outstanding and unexercised warrants and options to purchase shares of OpCo’s common stock, and in connection with the Merger they were converted into warrants and options, as applicable, to purchase shares of our common stock, with the number of shares subject to such warrant or option, and the exercise price, being appropriately adjusted to reflect the exchange rate of 0.4794 shares of our common stock for each share of OpCo common stock.

In the Merger, former OpCo security holders received approximately 86.24% of our fully diluted common stock and former Histogenics security holders were left with approximately 13.76% of our fully diluted common stock. In connection with the Merger, our board of directors (the “Board”) was replaced by new directors selected by OpCo, and all members of OpCo’s management team were installed as our new management team.

Unless otherwise indicated, all references in this proxy statement to “Ocugen,” “the Company,” “we,” “our” and “us” refer to Ocugen, Inc. as of and following the closing of the Merger and, where applicable, to the business of OpCo prior to the closing of the Merger, and all references to “Histogenics” refer to Histogenics Corporation and the business of Histogenics Corporation prior to the closing of the Merger.

JOBS Act Explanatory Note

We are an “emerging growth company” under applicable federal securities laws and are therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, including the compensation disclosure required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (1) the end of the fiscal year in which the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the end of the second fiscal quarter; (2) the end of the fiscal year in which we have the total annual gross revenue of $1.07 billion or more during the fiscal year; (3) the date in which we issue more than $1.0 billion in non-convertible debt in a three-year period or (4) December 31, 2019, the end of the fiscal year following the fifth anniversary of the completion of our initial public offering.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement | iv

Table of Contents

GENERAL INFORMATION ABOUT THE MEETING

PROXY SOLICITATION

Our Board is soliciting your vote on matters that will be presented at the Annual Meeting and at any adjournment or postponement thereof. This proxy statement contains information on these matters to assist you in voting your shares.

This proxy statement and the proxy card are being furnished to our stockholders on or about November 8, 2019. This proxy statement and our 2018 Annual Report on Form 10-K describing the former business of Histogenics Corporation are available to holders of our common stock at www.proxyvote.com. If you would like to receive, without charge, a paper copy of our 2018 Annual Report, including the financial statements, please send your request to Vice President, Investor Relations and Administration, Ocugen, Inc., 5 Great Valley Parkway, Suite 160, Malvern, PA 19355.

STOCKHOLDERS ENTITLED TO VOTE

All stockholders of record of our common stock at the close of business on October 25, 2019 (the “Record Date”), are entitled to receive the Notice and to vote their shares at the Annual Meeting. As of the Record Date, 12,206,587 shares of our common stock were outstanding. Each share is entitled to one vote on each matter properly brought to the meeting.

VOTING METHODS

You may vote at the Annual Meeting by delivering a proxy card in person or you may cast your vote in any of the following ways:

HOW YOUR SHARES WILL BE VOTED

i

Histogenics Corporation

830 Winter Street, 3rd Floor

Waltham, MA 02451

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

June 15, 2018

This Proxy Statement is furnished in connection with the solicitation of proxies to be voted at the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of Histogenics Corporation (sometimes referred to as “we,” the “Company” or “Histogenics”), which will be held on June 15, 2018, at 9:00 a.m. local time at the offices of Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP located at One Marina Park Drive, Suite 900, Boston, MA 02210.

We are making this Proxy Statement and our annual report on Form 10-K for the fiscal year ended December 31, 2017 (the “Annual Report”) available to stockholders at www.proxyvote.com. On or about April 26, 2018, we will begin mailing to certain of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access and review this Proxy Statement and the Annual Report. The Notice also instructs you how you may submit your proxy over the internet or via telephone. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the Notice.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving this proxy statement and proxy card?

You have received these proxy materials because you owned shares of Histogenics common stock as of April 23, 2018 (the “Record Date”), the record date for the Annual Meeting, and the Company’s Board of Directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting. This proxy statement describes issues on which we would like you to vote at the Annual Meeting. It also gives you information on these issues so that you can make an informed decision.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a printed set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are permitted to furnish our proxy materials over the internet to our stockholders by delivering the Notice in the mail. As a result, only stockholders who specifically request a printed copy of the proxy statement will receive one. Instead, the Notice instructs stockholders on how to access and review the Proxy Statement and Annual Report over the internet at www.proxyvote.com. The Notice also instructs stockholders on how they may submit their proxy via telephone or the internet. If a stockholder who received a Notice would like to receive a printed copy of our proxy materials, such stockholder should follow the instructions for requesting these materials contained in the Notice.

How may I vote at the Annual Meeting?

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy via telephone or on the internet. If you received a printed set of materials, you may also vote by mail by completing, signing, dating and returning the proxy card.

When you vote, regardless of the method used, you appoint Adam Gridley, our President and Chief Executive Officer, and Jonathan Lieber, our Chief Financial Officer, as your representatives (or proxyholders) at the Annual Meeting. They will vote your shares at the Annual Meeting as you have instructed them or, if an issue that is not on the proxy card comes up for vote, in accordance with their best judgment. This way,In each case, your shares will be voted whether oras you instruct. If you return a signed card, but do not you attend the Annual Meeting.

1

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business the Record Date,provide voting instructions, your shares will be entitled to vote at the Annual Meeting. On the Record Date, there were 28,687,412 sharesvoted FOR each of the Company’s common stock outstanding. All of these outstanding shares are entitled to vote at the Annual Meeting (one vote per share of common stock) in connection with the matters set forth in this Proxy Statement.

In accordance with Delaware law, a list of stockholders entitled to vote at the meeting will be available at the place of the Annual Meeting on the date of the Annual Meeting and will be accessible for ten days prior to the Annual Meeting at our principal place of business, 830 Winter Street, 3rd Floor, Waltham, MA 02451, during normal business hours.

How do I vote?

If, on the Record Date, your shares were registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., then you are a stockholder of record. Stockholders of record may vote via the internet, telephone or (if you received a proxy card by mail) mail as described below. If you hold shares in “street name” (i.e., you are the beneficial owner of shares held through a bank, broker or other nominee), please refer to your proxy card, the Notice or other information forwarded by your bank, broker or other nominee to see which voting options are available to you.

You may vote by using the internet. The address of the website for internet voting is www.proxyvote.com. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time the day before the Annual Meeting. Easy-to-follow instructions allow you to vote your shares and confirm that your instructions have been properly recorded.

You may vote by telephone. The toll-free telephone number is noted on the Notice and your proxy card. Telephone voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time the day before the Annual Meeting. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded.

You may vote by mail. If you received a proxy card by mail and choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope.

The method you use to vote will not limit your right to vote at the Annual Meeting if you decide to attend in person. Written ballots will be passed out to anyone who wants to vote at the Annual Meeting. If you hold shares in street name, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the Annual Meeting.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting.proposals. If you are the record holder of your shares, you may revoke or change your vote any time before the proxy in anyis exercised. To do so, you must do one of three ways:the following:

· Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. You may not revoke or change your vote over the Internet or by telephone after 11:59 p.m., Eastern Time, on December 17, 2019.

· Sign a new proxy card and submit a subsequentit by mail, which must be received no later than December 17, 2019. Only your latest dated proxy via the internet, telephone or mail with a later date;card will be counted.

| •

| You may deliver a written notice that you are revoking your proxy to the Corporate Secretary of the Company at 830 Winter Street, 3rd Floor, Waltham, MA 02451; or

|

You may attend

· Attend the Annual Meeting and vote your shares in person. Simply attendingperson as instructed above. Attending the Annual Meeting without affirmatively voting will not by itself revoke a previously granted proxy.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement | 1

Table of Contents

GENERAL INFORMATION ABOUT THE MEETING (CONTINUED) |

· Give our Corporate Secretary written notice before or at the meeting that you want to revoke your proxy.

If you hold your shares in street name, you must contact the bank, broker or other nominee holding your shares and follow their instructions for changing your vote.

2

How many votes do you need to receive in order to hold the Annual Meeting?

A quorum of stockholders is necessary to conduct business at the Annual Meeting. Pursuant to our amended and restated bylaws (the “Bylaws”), a quorum will be present if a majority of the voting power of outstanding shares of the Company entitled to vote generally in the election of directors is represented in person or by proxy at the Annual Meeting. On the Record Date, there were 28,687,412 shares of common stock outstanding and entitled to vote. Thus, 14,343,707 shares must be represented by stockholders present at the Annual Meeting or represented by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalfare held by your broker, bank or other nominee)holder of record as a nominee or if you attendagent (i.e., the Annual Meeting and vote in person. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present for the transaction of business. If a quorum is not present the chairman of the meeting or, the holders of a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another date.

What proposals will be voted on at the Annual Meeting?

The following table provides a description of the proposals that will be voted on at the Annual Meeting:

Proposal

| | Board

Recommendation

| | Vote

Required

| | Broker

Discretionary

Voting

Allowed

|

Proposal 1: Elect Joshua Baltzell and Kevin Rakin to serve as

Class I directors until the 2021 annual meeting of stockholders.

| | FOR

| | Plurality

| | No

|

Proposal 2: Ratify the selection of Grant Thornton LLP as our

independent registered public accountants for the year ending

December 31, 2018.

| | FOR

| | Majority

Votes Cast

| | Yes

|

Plurality means that the nominees for director receiving the greatest number of votes will be elected. Withheld votes and “broker non-votes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) will have no effect on the election of a nominee.

Majority Votes Cast means that a proposal that receives an affirmative majority of the votes cast will be approved. Abstentions and broker non-votes will not be counted “FOR” or “AGAINST” the proposal and will have no effect on the proposal.

Broker Discretionary Voting occurs when a broker does not receive voting instructions from the beneficial owner and votes those shares in its discretion on any proposal on which it is permitted to vote.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and broker non-votes. Broker non-votes, as described in the next paragraph, have no effect and will not be counted towards the vote total for Proposal 1 and Proposal 2.

If your shares are held in “street name”), you should follow the instructions provided by your broker, bank or other holder of record.

Deadline for Voting. The deadline for voting by telephone or Internet is 11:59 PM Eastern Time on December 17, 2019. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

BROKER VOTING AND VOTES REQUIRED FOR EACH PROPOSAL

If your shares and followare held in a stock brokerage account or by a bank or other holder of record, you are considered the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules on which your broker may vote“beneficial owner” of shares held in street name without your voting instructions. On non-discretionary items for whichname. The Notice has been forwarded to you do not giveby your broker, instructions, the shares will be treated as broker non-votes. Under current broker voting rules, any electionbank or other holder of a member of the Board, whether contested or uncontested,record who is considered “non-discretionary” and therefore brokers are not permittedthe stockholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares held in street name forby using the election of directorsproxy card included in the absence ofmaterials made available or by following their instructions for voting on the Internet.

A broker non-vote occurs when a broker or other nominee that holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from you. Proposal 1 is “non-discretionary”the beneficial owner of the shares. The following table summarizes how broker non-votes and therefore if you hold your shares throughabstentions are treated with respect to our proposals:

Proposal | Votes Required | Treatment of

Abstentions and Broker

Non-Votes

| Broker

Discretionary

Voting

|

Item 1: Election of Class II Directors for a Three-Year Term Expiring in 2022 | Plurality of the votes cast | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No |

Item 2: Ratification of Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2019 | Majority of the shares present, in person represented by proxy at the meeting, and entitled to vote | Abstentions and broker non-votes will have the effect of a vote “AGAINST” the proposal and broker non-votes will not be taken into account in determining the outcome of the proposal | Yes |

Item 3: To approve the adoption of our 2019 Plan | Majority of the shares present, in person represented by proxy at the meeting, and entitled to vote | Abstentions will have the effect of a vote “AGAINST” the proposal and broker non-votes will not be taken into account in determining the outcome of the proposal | No |

QUORUM

We must have a broker, bank or other agent, your shares will not be voted on Proposal 1 unless you provide voting instructionsquorum to the record holder.

3

Could other matters be decided at the Annual Meeting?

Histogenics does not know of any other matters that may be presented for actionconduct business at the Annual Meeting. Should any other business come beforeA quorum consists of the presence at the meeting either in person or represented by proxy of the holders of a majority of the voting power of our outstanding shares of

Notice of Annual Meeting the individuals named as proxies on the proxy card will have discretionary authorityof Stockholders and 2019 Proxy Statement | 2

Table of Contents

GENERAL INFORMATION ABOUT THE MEETING (CONTINUED) |

common stock entitled to vote the shares represented by proxiesgenerally in accordance with their best judgment. If you hold shares through a broker, bank or other nominee, they will not be able to vote your shares on any other business that comes before the Annual Meeting unless they receive instructions from you with respect to such other business.

What happens if a director nominee is unable to stand for election?

If a nominee is unable to stand for election, the Board may either:

reduce the number of directors that serve on the Board, or

designate a substitute nominee.

If the Board designates a substitute nominee, shares represented by proxies voted for the nominee who is unable to stand for election will be voted for the substitute nominee.

What happens if I submit my proxy but do not provide voting instructions?

If you submit a proxy via telephone, the internet or return a signed and dated proxy card without indicating instructions with respect to specific proposals, your shares will be voted:

Proposal 1: “FOR” the election of both Joshua Baltzell and Kevin Rakin as Class I directorsdirectors. For the purpose of establishing a quorum, abstentions, including brokers holding customers’ shares of record who cause abstentions to serve a term of three years until our 2021 annual meeting of stockholders; and

Proposal 2: “FOR” the ratification of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2018.

If any other matter is properly presentedbe recorded at the Annual Meeting,meeting, and broker non-votes are considered stockholders who are present and entitled to vote, and count toward the proxyholders forquorum. If there is no quorum, the holders of a majority of shares voted onpresent at the meeting in person or represented by proxy card (i.e., oneor the chairman of the individuals named as proxiesmeeting may adjourn the meeting to another date.

PROXY SOLICITATION COSTS

We pay the cost of soliciting proxies. Proxies will be solicited on your proxy card) will vote your shares using their best judgment.

What do I need to show to attend the Annual Meeting in person?

You will need proof of your share ownership asbehalf of the Record Date and a form of photo identification such as a valid driver’s license.

If you are not a stockholder of record but hold shares in street name, you must provide proof of beneficial ownership as of the Record Date, such as an account statement or similar evidence of ownership.

If you do not have proof of ownership and valid photo identification, you may not be admitted to the Annual Meeting. All bags, briefcases and packages will be held at registration and will not be allowed in the meeting. We will not permit the use of cameras (including cell phonesBoard by mail, telephone and other devices with photographic capabilities) and other recording deviceselectronic means or in the meeting room.

Who is paying for this proxy solicitation?

The accompanying proxy is being solicited by the Board. In addition to this solicitation, directors and employees of the Company may solicit proxies in person, by telephone, or by other means of communication.person. Directors and employees will not be paid any additional compensation for soliciting proxies. In addition, the CompanyWe may also retain one or more third parties to aid in the solicitation of brokers, banks and institutional and other stockholders. We will pay for the entire cost of soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

4

What happens if the Annual Meeting is postponed or adjourned?

Unless the polls have closed or you have revoked your proxy, your proxy will still be in effect and may be voted once the Annual Meeting is reconvened. However, you will still be able to change or revoke your proxy with respect to any proposal until the polls have closed for voting on such proposal.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results are expected to be announced at the Annual Meeting. Final voting results will be reported on a Current Report on Form 8-K filed with the SEC no later than the fourth business day after the Annual Meeting.

How can I find Histogenics’ proxy materials on the internet?

This Proxy Statement and the Annual Report are available on the “Investors” section of our corporate website located at http://ir.histogenics.com. You also can obtain copies without charge at the SEC’s website at www.sec.gov. Additionally, in accordance with SEC rules, you may access these materials at www.proxyvote.com, which does not have “cookies” that identify visitors to the site.

How do I obtain a separate set of Histogenics’ proxy materials if I share an address with other stockholders?

In some cases, stockholders holding their shares in a brokerage or bank account who share the same surname and address receive only one copy of the Notice. This practice, called “householding,” is designed to reduce duplicate mailings and save printing and postage costs as well as natural resources. If you would like to have a separate copy of the Notice, our Annual Report and/or this Proxy Statement mailed to you or to receive separate copies of future mailings, please submit your request to the address or phone number that appears on your Notice or proxy card. We will deliver such additional copies promptly upon receipt of such request.

In other cases, stockholders receiving multiple copies of proxy materials at the same address may wish to receive only one copy. If you would like to receive only one copy, please submit your request to the address or phone number that appears on your Notice or proxy card.

Can I receive future proxy materials electronically?

Yes. This Proxy Statement and the Annual Report are available on the “Investors” section of our corporate website located at http://ir.histogenics.com. Instead of receiving paper copies in the mail, stockholders can elect to receive an e-mail that provides a link to our future annual reports and proxy materials on the internet. Opting to receive your proxy materials electronically will save us the cost of producing and mailing documents to your home or business will reduce the environmental impact of our annual meetings of stockholders and will give you an automatic link to the proxy voting site.

May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors?

Yes. The following requirements apply to stockholder proposals, including director nominations, for our 2018 annual meeting of stockholders:

Requirements for Stockholder Proposals to be Considered for Inclusion in Histogenics’ Proxy Materials:

Stockholders interested in submitting a proposal (other than the nomination of directors) for inclusion in the proxy materials to be distributed by us for our 2019 annual meeting of stockholders may do so by following the procedures prescribed in Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion in Histogenics’ proxy materials, stockholder proposals must be received at our principal executive offices no later than the close of business on December 27, 2018 which is the 120th day prior to the first anniversary of the date that we released this Proxy Statement to our stockholders for the Annual Meeting. To be included in our proxy materials, your proposal also must comply with the Bylaws and Rule 14a-8 promulgated under the Exchange Act regarding the inclusion of stockholder proposals in company-sponsored proxy materials. If we change the date of the 2019 annual meeting of stockholders by more than 30 days from the

5

anniversary of the Annual Meeting, stockholder proposals must be received a reasonable time before we begin to print and mail our proxy materials for our 2019 annual meeting of stockholders. Such proposals should be sent to Histogenics Corporation, 830 Winter Street, 3rd Floor, Waltham, MA 02451, Attention: Corporate Secretary.

Requirements for Stockholder Nomination of Director Candidates and Stockholder Proposals Not Intended for Inclusion in Histogenics’ Proxy Materials:

Stockholders who wish to nominate persons for election to the Board at our 2018 annual meeting of stockholders or who wish to present a proposal at our 2019 annual meeting of stockholders, but who do not intend for such proposal to be included in the Company’s proxy materials for such meeting, must deliver written notice of the nomination or proposal to our Corporate Secretary at our principal executive offices no earlier than February 10, 2019, which is the 75th day prior to the first anniversary of the date we released this Proxy Statement to our stockholders for the Annual Meeting, and no later than March 12, 2019, which is the 45th day prior to the first anniversary of the date we released this Proxy Statement to our stockholders for the Annual Meeting. However, if we change the date of our 2019 annual meeting of stockholders by more than 30 days from the anniversary of this year’s Annual Meeting, such nominations and proposals must be received no later than the close of business on the later of (a) the 90th day prior to our 2019 annual meeting of stockholders and (b) the 10th day following the day we first publicly announce the date of our 2019 annual meeting of stockholders. The stockholder’s written notice must include certain information concerning the stockholder and each nominee and proposal, as specified in our Bylaws. If the stockholder does not also satisfy the requirements of Rule 14a-4 promulgated under the Exchange Act, the persons named as proxies will be allowed to use their discretionary voting authority when and if the matter is raised at the 2019 annual meeting of stockholders. Such nominations or proposals should be sent to Histogenics Corporation, 830 Winter Street, 3rd Floor, Waltham, MA 02451, Attention: Corporate Secretary.

Copy of Amended and Restated Bylaws:

You may request a copy of the Bylaws at no charge by writing to our Corporate Secretary at 830 Winter Street, 3rd Floor, Waltham, MA 02451. A current copy of the Bylaws also is available on the “Investors” section of our corporate website located at http://ir.histogenics.com.

Whom should I call if I have any questions?

If you have any questions, would like additional Histogenics proxy materials or proxy cards, or need assistance in voting your shares, please contact Investor Relations, Histogenics Corporation, 830 Winter Street, 3rd Floor, Waltham, MA 02451 or by telephone at (781) 547-7900.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE MEETING TO BE HELD ON FRIDAY, JUNE 15, 2018:

The Notice, this Proxy Statement and the Annual Report are available on-line at www.proxyvote.com.

6

BOARD OF DIRECTORS

Our Board has nominated Uday B. Kompella, Ph.D. and Manish Potti for election as Class II directors at our Annual Meeting to hold office until our 2022 Annual Meeting of Stockholders.

PROPOOur Board is our company’SAL 1s ultimate decision-making body, except with respect to those matters reserved to the stockholders. Our Board selects the members of our senior management team, who in turn are responsible for the day-to-day operations of our company. Our Board acts as an advisor and counselor to senior management and oversees its performance.

ELECTION OF DIRECTORS

UnderOur Board consists of directors divided into three classes, with each class holding office for a three-year term. Uday B. Kompella, Ph.D. and Manish Potti, current Class II directors, have been nominated by our Board for election at the Annual Meeting for three-year terms that will expire at the 2022 Annual Meeting of Stockholders and until their successors, if any, are elected or appointed, or upon their earlier death, resignation, retirement, disqualification or removal. Each of the nominees has agreed to be named and to serve, and we expect each nominee to be able to serve if elected. If any nominee is unable to serve, the Nominating and Corporate Governance Committee of our Board will recommend to our Board a replacement nominee. The Board may then designate the other nominee to stand for election. If you voted for the unavailable nominee, your vote will be cast for his or her replacement.

BOARD STRUCTURE AND COMPOSITION

The Nominating and Corporate Governance Committee of our Board is responsible for recommending the composition and structure of our Board and for developing criteria for Board membership. This Committee regularly reviews director competencies, qualities and experiences, with the goal of ensuring that our Board is comprised of an effective team of directors who function collegially and who are able to apply their experience toward meaningful contributions to our business strategy and oversight of our performance, risk management, organizational development and succession planning.

Our Amended and Restated Bylaws (“Bylaws”) provide that the number of members of our Board shall be fixed by the Board from time to time. Our Board was previously fixed at four members, until September 27, 2019, when we increased the size of the Board to seven members. Our Board is divided into three classes with staggered three-year terms. The Nominating and Corporate Governance Committee is responsible for identifying individuals that the Committee believes are qualified to become Board members.

CRITERIA FOR BOARD MEMBERSHIP

The Nominating and Corporate Governance Committee has identified certain criteria that it will consider in identifying director nominees. Important general criteria and considerations for Board membership include:

Notice of roughly equal size. The membersAnnual Meeting of each class are elected to serve a three-year term with the termStockholders and 2019 Proxy Statement | 3

Table of officeContents

CORPORATE GOVERNANCE AND RISK MANAGEMENT (CONTINUED) |

General Criteria

|

·Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. ·Nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company and should be willing and able to contribute positively to the decision-making process of the Company. ·Nominees should have a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board and its committees. ·Nominees should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interest of all stockholders. ·Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of the Company and its stockholders and to fulfill the responsibilities of a director. ·Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. The value of diversity on the Board should be considered. ·Nominees should have the potential to serve on the Board for at least five years. |

In each of the three classes ending in successive years. Pursuant to our amendeddirector nominee and restated Bylaws,continuing director biographies that follow, we highlight the Board has fixed the current number of directors at eight. Joshua Baltzellspecific experience, qualifications, attributes and Kevin Rakin are the two Class I directors whose terms expire at the Annual Meeting. Messrs. Baltzell and Rakin have been nominated for election byskills that led the Board to conclude that the director nominee or continuing director should serve until the 2021 annual meeting of stockholders or until their successors are elected (or until their earlier death, resignation or removal). It ison our policy to encourage nominees for director to attend the Annual Meeting.

Directors are elected by a plurality of the votes cast at the Annual Meeting. The two nominees receiving the highest number of “FOR” votes will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election of directors at the Annual Meeting.

Shares represented by signed proxy cards will be voted on Proposal 1 “FOR” the election of Messrs. Baltzell and Rakin to the Board at the Annual Meeting, unless otherwise marked on the card. If any Histogenics director nominee becomes unavailable for election as a result of an unexpected occurrence, shares represented by proxy will be voted for the election of a substitute nominee designated by our current Board, unless otherwise marked on the card. Messrs. Baltzell and Rakin, Histogenics’ two director nominees, have each agreed to serve as a director if elected. We have no reason to believe that any of the Histogenics nominees will be unable to serve if elected.

Nominees for Election as Class I Directors at the Annual Meeting

This year’s nominees for election to the Board as our Class I directors to serve for a term of three years expiring at the 2021 annual meeting of stockholders, or until their successors have been duly elected and qualified or until their earlier death, resignation or removal, are provided below. The age of each director as of the Record Date is set forth below.this time.

Name | | Age | | | Positions and Offices Held with Company | | Director Since |

Joshua Baltzell | | | 48 | | | Director | | 2012 |

Kevin Rakin | | | 57 | | | Director | | 2012 |

DIRECTOR NOMINEES

The following is additional information about each of the nominees as of the date of this Proxy Statement, including their business experience, public company director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Nominating/Corporate Governance Committee and the Board to determine that the nominees should serve as one of our directors.CLASS II DIRECTORS— PRESENT TERMS EXPIRING AT THE ANNUAL MEETING AND PROPOSED TERMS TO EXPIRE IN 2022

Joshua Baltzell

Uday B. Kompella, Ph.D.

| |

Age: 52 | Committee Memberships: Nominating and Corporate Governance Committee |

Director Since: 2019 | Other Public Directorships: None |

Uday B. Kompella, Ph.D. has served as a member of theour Board since July 2012. Mr. BaltzellSeptember 2019. Dr. Kompella has served as Co-Founder and as a member of the board of directors of OpCo since September 2013, when he and Dr. Musunuri co-founded OpCo. Dr. Kompella has served as a Professor of Pharmaceutical Sciences, Ophthalmology, and Bioengineering at University of Colorado-Anschutz Medical Campus since March 2008. He is a Venture Partner at Split Rock Partners,Fellow of the American Association of Pharmaceutical Scientists (AAPS) and alsothe Association for Research in Vision and Ophthalmology (ARVO) and serves as the Editor-in-Chief for the journal Expert Opinion on Drug Delivery. Also, he is an editor for the journals, Pharmaceutical Research and the Journal of Ocular Pharmacology and Therapeutics. Dr. Kompella obtained his undergraduate degree from the Birla Institute of Technology and Science, a Venture Partner at SightLine Partners. He has been with Split Rock since 2004Master’s Degree

Notice of Annual Meeting of Stockholders and with SightLine since 2014. Mr. Baltzell has over 20 years2019 Proxy Statement | 4

Table of experience Contents

CORPORATE GOVERNANCE AND RISK MANAGEMENT (CONTINUED) |

in the healthcare industry. Prior to his tenurePharmaceutical Engineering from Jadavpur University and a Ph.D. in the venture capital industry, Mr. Baltzell held roles as an investment banker at Piper Jaffray Companies from 2000 to 2002, where he focused primarily on mergers and acquisitions in the medical device sector, as well as various marketing and business development positions with SCIMED and Boston Scientific. Mr. Baltzell currently serves on the boards of Magnolia Medical, ViewPoint Medical and Colorescience. Mr. Baltzell holds a B.A. in Economics from St. Olaf College and an M.B.A.Pharmaceutical Sciences from the University of Minnesota’s Carlson SchoolSouthern California.

Skills & Qualifications: Our Board believes Dr. Kompella’s deep experience with our business as a co-founder of Management. We believe that Mr. Baltzell’sOpCo and his academic experience in pharmaceutical sciences and ophthalmology provides him with the qualifications and skills to serve as a director of the Company include his extensive experience in the venture capital industry, his investment banking experience in the healthcare and medical device industries with both public and privately held companies and his significant prior board experience.on our Board.

7

Manish Potti

| |

Age: 33 | Committee Memberships: Audit Committee; Compensation Committee |

Director Since: 2019 | Other Public Directorships: None |

Kevin RakinManish Potti has served as a member of theour Board since October 2012.September 2019. Mr. Rakin is a co-founder and Partner at HighCape Partners, a growth equity life sciences fund where hePotti has served since November 2013. From June 2011 to November 2012, Mr. Rakin was the President of Regenerative Medicine at Shire plc, aleading specialty biopharmaceutical company. Mr. Rakin currently serves on a number of boards, including Oramed Pharmaceuticals, Inc., Cheetah Medical Inc. and TELA Bio, Inc.Mr. Rakin holds an M.B.A. from Columbia University and received his graduate and undergraduate degrees in Commerce from the University of Cape Town, South Africa. We believe that Mr. Rakin’s qualifications to serve as a director of the Company include his extensive experience as an executive in the biotechnology industry, as well as his service in positions in various companies as a chief executive officer, chief financial officer and president and his involvement in public and private financings and mergers and acquisitions in the biotechnology industry.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF

JOSHUA BALTZELL AND KEVIN RAKIN AS CLASS I DIRECTORS

Continuing Directors Not Standing for Election

Certain information about those directors whose terms do not expire at the Annual Meeting is furnished below, including their business experience, public company director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Nominating/Corporate Governance Committee and the Board to determine that the directors should serve as one of our directors. The age of each director as of the Record Date is set forth below.

Name | | Age | | | Positions and Offices Held with Company | | Director Since |

David Gill | | | 63 | | | Director | | 2015 |

Adam Gridley | | | 45 | | | President, Chief Executive Officer and Director | | 2014 |

John H. Johnson | | | 60 | | | Director | | 2013 |

Garheng Kong, M.D., Ph.D. | | | 42 | | | Director, Chairman of the Board | | 2012 |

Michael Lewis | | | 59 | | | Director | | 2011 |

Susan B. Washer | | 56 | | | Director | | 2018 |

Class II Directors (Terms Expire in 2019)

Adam Gridley has served as our Chief Executive Officer and President since May 2014. Mr. Gridley previously served from October 2012 until May 2014 as Senior Vice President of Technical Operations at Merz North America, Inc., the North American business unit of Merz, Inc., a privately-held pharmaceuticals company. From September 2011 to October 2012, he was Senior Vice President, Operations & Product Development responsible for global research and development and manufacturing for Merz Aesthetics, Inc., a global business unit of Merz, Inc., and from July 2010 to September 2011, Mr. Gridley held the position of Senior Vice President, Product Development at Merz. From September 2008 to July 2010, Mr. Gridley was Senior Vice President, Corporate Development for BioForm Medical, Inc., a publicly-traded company acquired by Merz, Inc. Mr. Gridley holds a B.S. and an M.B.A. from the University of Denver. We believe that Mr. Gridley’s qualifications to serve as a director of the Company include his extensive experience as an executive in the biotechnology industry and his prior service as a senior-level executive in both early stage and mature biotechnology companies.

Michael Lewis has served as a member of the Board since May 2011. Mr. Lewis has more than 25 years of experience in the investment management and retail industries. Mr. Lewis is currently Chairman of Oceana Investment Corporation Limited, a private U.K. investment company. Mr. Lewis currently serves as Chairman of Strandbags Holdings Pty Limited, an Australian retail company comprising some 300 stores and Chairman and Non-Executive Director of The Foschini Group Limited, a South African retail company with some 4,000 stores. Mr. Lewis serves on the board of United Trust Bank Limited, a U.K.-based bank, and served on the Supervisory Board of Axel Springer AG in Germany from 2007 to September 2012. Mr. Lewis previously worked for Ivory and Sime, a money manager based in Scotland, and Lombard Odier, a money manager based in England. He has an undergraduate degree and a postgraduate degree from the University of Cape Town. We believe Mr. Lewis’ qualifications to serve as a director of the Company include his extensive experience in money management, and as an investor and director of biomedical and other companies.

8

Susan B. Washer has served as a member of the Board since April 2018. Ms. Washer is the President and Chief Executive Officer of Applied Genetic Technologies Corporation (“AGTC”), where she has served in such capacity since March 2002 and as a member of its board of directors since November 2003. Ms. Washer was also AGTC’s chief operating officer from October 2001 to March 2002. From June 1994 to October 2001, Ms. Washer led two entrepreneurial firms including serving as president and chief executive officer of Scenic Productions and as the Founding Executive Director and then Business Advisor for the North Florida Technology Innovation Center, a public-private organization financing and providing services to entrepreneurial companies licensing STEM based technology from Florida universities. Ms. Washer currently serves on the board of directors of Biotechnology Innovation Organization (“BIO”) and the Alliance for Regenerative Medicine. Previously, Ms. Washer served as chairman of the BioFlorida board and the Southeast BIO board and continues her involvement with both organizations as a member of their respective boards. From October 1983 to June 1994, Ms. Washer served in various research and pharmaceutical management positions with Abbott Laboratories and Eli Lilly and Company. Ms. Washer received a B.S. in biochemistry from Michigan State University and an M.B.A. from the University of Florida. We believe that Ms. Washer’s qualifications to serve as a director of the Company include her education and professional background in science and business management, her years of experience in the pharmaceutical and biotechnology industries and her service as a senior executive of early and late stage biotechnology companies.

Class III Directors (Terms Expire in 2020)

David Gill has served as a member of the Board since February 2015. Mr. Gill served as the President and Chief Financial Officer of EndoChoice, Inc., a medical device company focused on gastrointestinal disease from April 2016 through the sale of the company to Boston Scientific in November 2016 and as Chief Financial Officer from August 2014 to April 2016. Previously, he served as the Chief Financial Officer of INC Research, a clinical research organization, from February 2011 to August 2013 after having served as a board member and its audit committee chairman from 2007 to 2010. Mr. Gill was the Chief Financial Officer of TransEnterix, Inc., a medical device company, from March 2009 to February 2011. Mr. Gill also currently serves on the boards of Melinta Therapeutics, Inc. (f/k/a Cempra, Inc.), Evolus, Inc. and YmAbs Therapeutics, Inc. Mr. Gill previously served as a director of two public life science company boards, LeMaitre Vascular, Inc. and IsoTis OrthoBiologics, Inc. and several private life science companies from 2006 to 2009. Earlier in his career Mr. Gill served in a variety of senior executive leadership roles for several publically-traded companies including NxStage Medical, CTI Molecular Imaging, Inc., Interland Inc. and Novoste Corporation. Mr. Gill holds a B.S. degree, cum laude, in Accounting from Wake Forest University and an M.B.A. degree, with honors, from Emory University, and was formerly a certified public accountant. We believe that Mr. Gill’s qualifications to serve as a director of the Company include his extensive experience as an executive in the life sciences industry and his extensive prior service as a director in other public and private mature life sciences companies.

John H. Johnson has served as a member of the Board since November 2013. Mr. Johnson served as President and Chief Executive Officer of Dendreon Corporation from January 2012 to August 2014. Mr. Johnson previously served as the Chief Executive Officer and a director of Savient Pharmaceuticals, Inc., a pharmaceutical company, from January 2011 until January 2012, and prior to that time, served as Senior Vice President and President of Eli Lilly and Company’s oncology unit from November 2009 until January 2011. He was also Chief Executive Officer of ImClone Systems Incorporated from 2007 until November 2009, and served on ImClone’s board of directors until it was acquired by Eli Lilly in 2008. Prior to joining ImClone, Mr. Johnson served as Company Group Chairman of Johnson & Johnson’s Worldwide Biopharmaceuticals unit from 2005 until 2007, President of its Ortho Biotech Products LP and Ortho Biotech Canada units from 2003 until 2005, and Worldwide Vice President of its CNS, Pharmaceuticals Group Strategic unit from 2001 until 2003. Mr. Johnson currently serves as chairman of the board of directors of Strongbridge Biopharma plc, and as a director of AVEO Pharmaceuticals, Inc., Melinta Therapeutics, Inc. (f/k/a Cempra, Inc.) and Portola Pharmaceuticals, Inc. He also served as a member of the board of directors of OpCo, our wholly-owned subsidiary, since November 2016 and has served as Co-Founder and President of Innogenix Pharma, a generic and specialty pharmaceutical company, since June 2016. He was previously Director of Business Development at Epic Pharma, a generic pharmaceutical company and contract manufacturing organization, from December 2014 to May 2016. Prior to his employment with Epic Pharma, Mr. Potti worked as an analyst at One William Street Capital from August 2010 to February 2014 and served as a consultant in the financial industry relating to fixed income portfolios from March 2014 to December 2014. Prior to his experience in pharmaceuticals, Mr. Potti spent several years in finance as an analyst and trader, working in investment banking and hedge funds. Mr. Potti holds a Bachelor’s of Science in Cellular and Molecular Biology from Johns Hopkins University, and a Master’s Degree in Financial Engineering from New York University.

Skills & Qualifications: Our Board believes Mr. Potti’s financial knowledge and significant investing experience, along with his previous experience in the pharmaceutical industry, provides him with the qualifications and skills to serve on our Board.

CONTINUING DIRECTORS

CLASS I DIRECTORS —TERMS EXPIRING AT THE 2021 ANNUAL MEETING OF STOCKHOLDERS

Skills & Qualifications:

Shankar Musunuri, Ph.D., MBA

| |

Age: 55 | Committee Memberships: None |

Director Since: 2019 | Other Public Directorships: None |

| | |

Shankar Musunuri, Ph.D., MBA has served as Chairman of the Board and as our Chief Executive Officer since September 2019. Dr. Musunuri has served as the Co-Founder and Executive Chairman of the Board of OpCo, our wholly-owned subsidiary, since September 2013 and has served as OpCo’s Chief Executive Officer since May 2015. Dr. Musunuri was a Founder, President, Chief Executive Officer, and a board member of Nuron Biotech, Inc. from April 2010 to May 2013. Previously, Dr. Musunuri spent nearly fifteen years at Pfizer Inc. where he had held various positions of increasing leadership and responsibility. Prior to Pfizer, Dr. Musunuri worked for Amylin Pharmaceuticals from 1993 to 1996. Dr. Musunuri obtained his Ph.D. in Pharmaceutical Sciences from the Pharmaceutical ResearchUniversity of Connecticut

Notice of Annual Meeting of Stockholders and Manufacturers2019 Proxy Statement | 5

Table of America Contents

CORPORATE GOVERNANCE AND RISK MANAGEMENT (CONTINUED) |

and an MBA from Duke University’s Fuqua School of Business. He serves on the Advisory Board of Fuqua’s Center for Entrepreneurship and Innovation.

Skills & Qualifications: Our Board believes Dr. Musunuri’s perspective and history as our Co-Founder and Chief Executive Officer, as well as his executive, operational and commercial expertise, qualify him to serve on our Board.

Ramesh Kumar, Ph.D.

| |

Age: 63 | Committee Memberships: Audit Committee (Chair); Nominating and Corporate Governance Committee |

Director Since: 2019 | Other Public Directorships: None |

Ramesh Kumar, Ph.D., has served as a member of the Health Section Governingour Board of Biotechnology Industry Organization. He earned his B.S. from the East Stroudsburg University of Pennsylvania. We believe that Mr. Johnson’s qualifications to servesince September 2019. Dr. Kumar has served as a director of OpCo, our wholly-owned subsidiary, since June 2019. He co-founded Onconova Therapeutics, Inc. in 1998 and served as its Chief Executive Officer and a member of its board from 1998 to February 2019 and as its President from 1998 to June 2018. Dr. Kumar transitioned to an Advisory role with Onconova in January 2019. He has held positions in R&D and management at Princeton University, Bristol-Myers Squibb, DNX (later Nextran, a subsidiary of Baxter) and Kimeragen (later Valigen), where he served as President of the Company includeGenomics and Transgenics Division. Dr. Kumar obtained an undergraduate and Master’s degree in Microbiology from Panjab University and received his Ph.D. in Molecular Biology from the University of Illinois, Chicago and trained at the National Cancer Institute.

Skills & Qualifications: Our Board believes Dr. Kumar’s extensive senior executive and public company experience, as an executive inand familiarity with the biotechnologypharmaceutical industry and his prior servicequalify him to serve on our Board.

Junge Zhang, Ph.D.

| |

Age: 52 | Committee Memberships: Compensation Committee; Nominating and Corporate Governance Committee (Chair) |

Director Since: 2019 | Other Public Directorships: None |

Junge (John) Zhang, Ph.D. has served as a senior-level executive in mature biotechnology companies.

Garheng Kong, M.D., Ph.D.member of our Board since September 2019. Dr. Zhang has served as a member of the board of directors of OpCo, our wholly-owned subsidiary, since May 2015. Dr. Zhang has served as the Founder, President, and CEO of Biopeptek Pharmaceuticals LLC, a custom peptide manufacturing company, since its founding in October 2010. Prior to founding Biopeptek, Dr. Zhang was with the Janssen Pharmaceutical division of Johnson & Johnson from October 2002 to April 2011. Before joining Johnson & Johnson, Dr. Zhang was a Senior Chemist at Eisai USA from December 1997 to October 2002. Dr. Zhang earned a Ph.D. in analytical chemistry from Drexel University, an M.S. in chemistry from University of Louisiana, and a B.S. in material science from Wuhan University of Technology in China.

Skills & Qualifications: Our Board believes Dr. Zhang’s extensive senior management experience in the pharmaceutical industry provides him with the qualifications and skills to serve on our Board.

CLASS III DIRECTORS —TERMS EXPIRING AT THE 2020 ANNUAL MEETING OF STOCKHOLDERS

Frank N. Leo

| |

Age: 63 | Committee Memberships: Compensation Committee (Chair) |

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement | 6

Table of Contents

CORPORATE GOVERNANCE AND RISK MANAGEMENT (CONTINUED) |

Director Since: 2019 | Other Public Directorships: None |

Frank N. Leo has served as a member of our Board since July 2012. Dr. KongSeptember 2019. Mr. Leo has been the Managing Partner of HealthQuest Capital, a healthcare investment firm, since July 2013. He was a general partner at

9

Sofinnova Ventures, a venture capital firm focused on life sciences, from September 2010 to December 2013. From 2000 to September 2010, he was at Intersouth Partners, a venture capital firm, most recentlyserved as a general partner. Dr. Kong has served onmember of the board of directors of Melinta Therapeutics,OpCo, our wholly-owned subsidiary, since February 2017. Since January 2008, Mr. Leo has served as a consultant, specializing in the pharmaceutical industry and private equity with over 30 years of experience in healthcare and pharmaceuticals. From 1999 to 2004, Mr. Leo served as President and Group President of Sterile Technologies and Life Sciences at Cardinal Health Inc. (f/k/Mr. Leo left Cardinal Health in 2004 but continued to serve as a Cempra, Inc.) since 2006 and as chairman of its board from 2008 to 2017. Dr. Kong hasretained advisor through 2005. Mr. Leo also served as Chief Executive Officer of Morton Grove Pharmaceuticals from 2006 to 2007. Mr. Leo has served as a Board Member of Rx Elite, Monogen, GeneraMedix, Iogenetics and Capsugel and currently serves as a Board Member of Leiters Compounding and Azurity Pharmaceuticals. Mr. Leo attended Loyola University Chicago.

Skills & Qualifications: Our Board believes Mr. Leo’s experience serving as an executive in the health care services industry, as well as his extensive knowledge of the pharmaceutical sector, provides him with the qualifications and skills to serve on our Board.

Suha Taspolatoglu, M.D.

| |

Age: 58 | Committee Memberships: Audit Committee |

Director Since: 2019 | Other Public Directorships: None |

| | |

Suha Taspolatoglu, M.D. has served as a member of our Board since September 2019. Dr. Taspolatoglu has served as a member of the board of directors of Strongbridge Biopharma plcOpCo, our wholly-owned subsidiary, since September 2015,June 2017. Since 2013, Dr. Taspolatoglu has been working as the boardChief Executive Officer of directorsAbdi Ibrahim Ilac Sanayi ve Ticaret A.S, a pharmaceutical company. Dr. Taspolatoglu joined Abdi Ibrahim as the head of Alimera Sciences, Inc. since October 2012sales and onmarketing division in 2001 and became managing director of sales and marketing division in 2007. From 2009 to 2013, Dr. Taspolatoglu worked as the boardGeneral Manager of directorsRoche Turkey. Dr. Taspolatoglu is a graduate of Laboratory CorporationAnkara University Faculty of America Holdings since December 2013.Medicine and served from 1986 to 1989 as a physician in the Ministry of Health..

Skills & Qualifications: Our Board believes Dr. Kong holds a B.S. from Stanford University. He holds an M.D., Ph.D.Taspolatoglu’s background in marketing and an M.B.A. from Duke University. We believe that Dr. Kong’ssales in the pharmaceutical sector provides him with the qualifications and skills to serve as a directoron our Board.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement | 7

Table of Contents

CORPORATE GOVERNANCE AND RISK MANAGEMENT (CONTINUED) |

CORPORATE GOVERNANCE AND RISK MANAGEMENT |

We are committed to good corporate governance and integrity in our business dealings. Our governance practices are documented in our Sixth Amended and Restated Certificate of Incorporation (the “Charter”), our Bylaws, our Code of Business Conduct and Ethics (the “Code of Conduct”), our Corporate Governance Guidelines and the charters of the Company include his knowledge and experience in the venture capital industry, his medical training and his significant prior board experience with both public and privately held companies.

10

CORPORATE GOVERNANCE

Independencecommittees of the Board (the “Committees”). Aspects of our governance documents are summarized below. You can find the charter for each Committee of the Board and our Code of Conduct on our website www.Ocugen.com under “Investors.”

BOARD INDEPENDENCE

Our Board has determined all of our directors, except for Dr. Musunuri, are “independent” directors, as defined under the rules of Nasdaq. In making such determination, the Board considered the relationships that each such non-employee director has with the Company and all other facts and circumstances that the Board deemed relevant in determining their independence, including the beneficial ownership of our common stock by each non-employee director. Our independent directors generally meet in executive session at each regularly scheduled Board meeting.

The Histogenics Board of Directors determined that in the fiscal year ended December 31, 2018, the following directors were “independent” directors, as defined under the rules of Nasdaq: David Gill; John H. Johnson; Garheng Kong, M.D., Ph.D.; Kevin Rakin; Susan Washer; Michael Lewis and Josh Baltzell. Adam Gridley, Histogenics’ former Chief Executive Officer, served on the Histogenics Board of Directors and was deemed not “independent” by virtue of being an employee of Histogenics.

As

BOARD LEADERSHIP STRUCTURE

The Board should remain free to configure the leadership of the Board and the Company in the way that best serves the Company’s interests at the time and, accordingly, has no fixed policy with respect to combining or separating the offices of the Chairman of the Board and the Chief Executive Officer. Dr. Shankar Musunuri, our Chief Executive Officer, currently serves as the Chairman of the Board. Combining the roles of chief executive officer and chairman of the Board fosters accountability, effective decision-making and alignment between interests of the Board and management.

In the event that the Chairman is not independent, the Board may, but is not required under Nasdaq listing standards,to, appoint a Lead Independent Director, who shall be selected by a majority of the membersindependent directors and who shall preside over executive sessions of a listed company’s boardthe Board. As of directors must qualify as “independent,” as affirmatively determined by the boarddate of directors. Consistent with these regulations, after review of all relevant transactions or relationships between each director, or any of his family members, and the Company, its senior management and its independent registered public accounting firm,this Proxy Statement, the Board has determined that allnot appointed a Lead Independent Director. The Nominating and Corporate Governance Committee shall periodically assess the Board’s leadership structure and whether the Board’s leadership structure is appropriate given the specific characteristics or circumstances of the Company.

BOARD COMMITTEES

Our Board has established various Committees to assist in discharging its duties: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each member of our directorsCommittees is an independent director as that term is defined by the Securities and Exchange Commission (the “SEC”) and Nasdaq. The primary responsibilities of each of the Committees and the Committee memberships are independent directors withinprovided below under the meaningsection entitled “Board Attendance, Committee Meetings and Committee Membership.”

Each of applicable Nasdaq listing standards, exceptthe Committees has the authority, as its members deem appropriate, to engage legal counsel or other experts or consultants in order to assist the Committee in carrying out its responsibilities.

Notice of Annual Meeting of Stockholders and 2019 Proxy Statement | 8

Table of Contents

CORPORATE GOVERNANCE AND RISK MANAGEMENT (CONTINUED) |

RISK MANAGEMENT